A Beginner’s Guide to MQL4 and Custom Indicators

What is MQL4?

If you’ve been around Forex trading or have used MetaTrader 4 (MT4), you’ve likely come across MQL4. So, what exactly is MQL4? Simply put, MQL4 (MetaQuotes Language 4) is a programming language specifically designed for creating trading robots, custom indicators, and scripts on the MT4 platform. It’s like the brain behind the scenes, automating trading tasks and letting you customize the platform to suit your trading style.

Whether you’re looking to build automated strategies or custom tools to analyze the market, MQL4 is your go-to language. And the good news? You don’t need to be a professional programmer to get started.

Why MQL4 is Important for Forex Trading

The Forex market is fast-paced, and having tools that can help you make better trading decisions quickly is crucial. This is where MQL4 shines. By using MQL4, you can:

- Automate trading strategies, saving you time and effort.

- Develop custom indicators to help you understand market trends more clearly.

- Create scripts to perform tasks faster, like closing all trades at once.

In essence, MQL4 lets you take control of your trading. Instead of relying solely on the built-in tools of MetaTrader, you can tweak things to fit your exact needs.

Who Should Learn MQL4?

You might be wondering, “Is MQL4 for me?” If you are serious about trading, the answer is likely yes. Here’s why:

- Manual traders who want to enhance their analysis with custom indicators.

- Automated traders looking to create expert advisors (EAs) to trade on their behalf.

- Anyone looking to gain an edge in the market by building tools that others may not have access to.

MQL4 can be learned by anyone with a bit of patience. You don’t need to be a coding wizard to pick it up. Once you understand the basics, you’ll start seeing how powerful it can be in improving your trading results.

Getting Started with MQL4

Installing MetaTrader 4

Before we dive into writing code, we need to make sure you have the right tools set up. The first step in learning MQL4 is installing MetaTrader 4 (MT4), which is where all the magic happens. It’s free, easy to download, and essential for working with MQL4. Here’s how you can do it:

- Go to the MetaTrader 4 website and download the platform.

- Follow the installation steps (it’s pretty straightforward).

- Once installed, log in to your trading account or create a demo account if you’re just practicing.

MT4 is a powerful platform with built-in tools, but its real power comes from what you can add to it using MQL4.

Setting Up the MetaEditor

After installing MT4, the next thing you need is the MetaEditor. This is where you’ll actually write your MQL4 code. Don’t worry—it’s user-friendly, and you don’t need to be a coding expert to get started.

To open the MetaEditor, just click on Tools > MetaQuotes Language Editor in MT4, or you can press F4 on your keyboard. The editor will open in a new window, and this is where all the fun begins.

Once inside, you’ll see a simple text editor where you can create Expert Advisors (EAs), Indicators, and Scripts. We’ll start small, but soon you’ll be customizing your trading experience in no time.

Basic Structure of MQL4 Code

MQL4 code might seem a bit intimidating at first, but trust me, it’s easier than it looks. Let’s break down the basics so you can get comfortable.

Every MQL4 file starts with some core sections, whether you’re writing an EA, an indicator, or a script:

- OnInit(): This function runs when your code is first loaded, setting things up.

- OnDeinit(): This is called when your code is removed from the chart.

- OnTick(): This is the most important one! It runs every time the price moves (on every “tick”).

For example, if you’re building a simple indicator, most of the logic would go into the OnTick() function, as that’s where you’ll be analyzing price movements.

Here’s a super basic example of how an MQL4 file might look:

//+------------------------------------------------------------------+

//| Example.mq4 |

//+------------------------------------------------------------------+

int OnInit()

{

// Code to run when the indicator is first loaded

return(INIT_SUCCEEDED);

}

void OnTick()

{

// Code to run on every tick (price update)

}This is a barebones template, but don’t worry—you’ll get comfortable with this structure as we go along.

Understanding the MetaEditor Interface

When you first open the MetaEditor, you might feel a little lost, but the layout is actually quite simple. Here’s a quick overview:

- Navigator Window: On the left side, you’ll see a list of all your MQL4 files, including indicators, scripts, and EAs.

- Code Editor: In the middle is where you’ll actually write your code.

- Compiler Output: At the bottom, this window will show any errors when you compile your code.

The editor is designed to make things as easy as possible, with features like auto-complete, syntax highlighting, and a debugger to help you spot any mistakes.

Understanding Indicators in MQL4

What Are Indicators?

If you’re new to trading, you’ve probably heard of indicators but might not fully understand what they do. In simple terms, indicators are tools that help traders make better decisions by analyzing price data and presenting it in a visual format. Whether it’s showing trends, overbought/oversold conditions, or potential price reversals, indicators are essential in technical analysis.

In MetaTrader 4, you have two main types of indicators:

- Built-in indicators, which come pre-installed in MT4.

- Custom indicators, which you or others can create using MQL4.

Indicators don’t predict the future—they help you interpret what’s happening in the market right now, giving you a better chance to make smart trades.

How Indicators Help Traders

So, why use indicators? As a trader, you need to understand market trends, patterns, and conditions before placing trades. Indicators make this easier by giving you a clear visual representation of these elements.

For example:

- Trend indicators like Moving Averages show you the overall direction of the market.

- Momentum indicators like the RSI help you identify overbought or oversold conditions.

- Volume indicators show how much trading activity is happening at certain price levels.

By using indicators, you can take the guesswork out of your trades and rely on data-driven insights.

Types of Built-in Indicators in MetaTrader 4

MetaTrader 4 comes with several built-in indicators that are popular among traders. Let’s go over a few of the most commonly used ones:

Moving Averages

A Moving Average (MA) is a simple but powerful tool that smooths out price data to identify the direction of the trend. There are different types, such as Simple Moving Average (SMA) and Exponential Moving Average (EMA), but they all serve the same purpose: to help you see whether the market is in an uptrend, downtrend, or sideways.

RSI (Relative Strength Index)

The RSI is a momentum indicator that shows whether an asset is overbought or oversold. It ranges from 0 to 100, with values above 70 indicating an overbought market and values below 30 suggesting it’s oversold. Traders often use the RSI to spot potential reversals.

MACD (Moving Average Convergence Divergence)

The MACD combines two moving averages and is used to identify changes in momentum and the strength of trends. When the MACD line crosses above the signal line, it’s considered a bullish signal; when it crosses below, it’s a bearish signal.

Stochastic Oscillator

The Stochastic Oscillator helps you identify overbought and oversold conditions, similar to the RSI. It compares the current price to a range of prices over a specific time period and helps you spot potential reversals.

Introduction to Custom Indicators

What Are Custom Indicators?

So, what exactly are custom indicators? In simple terms, they’re indicators you can create yourself to fit your personal trading style or specific needs. While MetaTrader 4 comes with many built-in indicators, you might find that none of them perfectly match what you’re looking for. That’s where custom indicators come into play.

With MQL4, you can code your own indicators to track market data in ways that the default indicators can’t. Whether it’s tweaking existing indicators or building something entirely new, custom indicators give you the flexibility to create exactly what you need.

Why Use Custom Indicators?

You might be wondering, “Why go through the hassle of making a custom indicator when there are so many already available?” Well, here are a few reasons why traders use custom indicators:

- Personalization: Custom indicators allow you to design a tool that fits your unique trading style. You can tweak settings, combine multiple indicators, or even add specific features that built-in ones don’t have.

- New Insights: Sometimes, the built-in indicators aren’t enough. By creating a custom indicator, you can get insights that are more aligned with your trading strategy. You can experiment and find new ways to analyze market data.

- Competitive Edge: Using a custom indicator can give you an edge over other traders who only use standard tools. If your indicator provides unique information, you’re already ahead of the game.

Examples of Popular Custom Indicators

Custom indicators are widely used in the trading community, and there are plenty of examples out there. Some of the most popular ones have been created to improve upon the built-in tools. Here are a few well-known custom indicators:

- Custom Moving Averages: Traders often modify standard Moving Averages to create custom versions that better suit their strategies, like combining different periods or using alternative calculation methods.

- Heiken Ashi Smoothed: This custom indicator smooths out price action and helps traders see trends more clearly. It’s popular because it reduces market noise and makes trends easier to follow.

- Pivot Points with Custom Timeframes: Many traders like to calculate pivot points using non-standard timeframes. A custom indicator can help you calculate these points based on any period you choose.

Building Custom Indicators: The Basics

Building your own custom indicators might sound challenging, but once you understand the basics, it’s actually quite manageable. MQL4 has built-in functions that make it easier to handle market data and create visual outputs on the chart.

Here’s a very simplified process of how you might start building a custom indicator:

- Decide what you want to achieve: What kind of market data do you want to analyze? Are you looking for trends, momentum, or something else?

- Use MQL4 functions: MQL4 comes with built-in functions like iClose, iOpen, iHigh, and iLow, which allow you to access historical price data. You’ll use these to build the logic of your custom indicator.

- Plot the data: Once you’ve calculated the values, the next step is to plot them on the chart. You can use indicator buffers and graphical tools to display the information visually.

For example, if you’re creating a custom moving average, you would first gather the closing prices over a certain period, calculate the average, and then display that line on the chart.

How Custom Indicators Differ from EAs

It’s important to note that custom indicators are not the same as Expert Advisors (EAs). Indicators help you analyze the market, while EAs are designed to execute trades automatically. While you can use indicators as part of an EA’s logic, their primary purpose is to assist with decision-making rather than trading on your behalf.

Writing Your First MQL4 Indicator

So, you’re ready to take the leap and write your first custom indicator in MQL4. Don’t worry—it’s not as complicated as it might sound! In this section, I’ll walk you through the process step-by-step, and by the end, you’ll have created your own simple indicator.

Step-by-Step Guide to Writing a Simple Indicator

Let’s start by creating something basic: a custom Moving Average. We’re going to code an indicator that calculates the moving average and displays it on the chart. Here’s how we do it:

Step 1: Open MetaEditor

First, open the MetaEditor by pressing F4 in MetaTrader 4. Once inside, you’ll see an option to create a new file. Select “Custom Indicator” and hit Next.

Step 2: Name Your Indicator

Give your indicator a name. Let’s call it “SimpleMA”. After that, you can leave the rest of the default settings as they are and click Finish.

Step 3: Set Up Indicator Buffers

In MQL4, buffers are used to store the values that the indicator will calculate. We’ll need one buffer to hold the moving average values. Add this line inside the code to define the buffer:

double MA_Buffer[];Step 4: Initialize the Indicator

Now, let’s add some code inside the OnInit() function. This is where we set up the basics of our indicator, like its appearance on the chart.

int OnInit()

{

SetIndexBuffer(0, MA_Buffer); // Assign buffer to index

SetIndexStyle(0, DRAW_LINE); // Draw the buffer as a line

IndicatorShortName("Simple Moving Average");

return(INIT_SUCCEEDED);

}This tells MetaTrader that we’re creating an indicator that will draw a line based on the MA_Buffer data.

Step 5: Calculate the Moving Average

The OnCalculate() function is where the actual calculation happens. We’ll use the iMA() function, which is a built-in MQL4 function for calculating the moving average.

int OnCalculate(const int rates_total,

const int prev_calculated,

const datetime &time[],

const double &open[],

const double &high[],

const double &low[],

const double &close[],

const long &tick_volume[],

const long &volume[],

const int &spread[])

{

for(int i=0; i<rates_total; i++)

{

MA_Buffer[i] = iMA(NULL, 0, 14, 0, MODE_SMA, PRICE_CLOSE, i);

}

return(rates_total);

}Here, we’re calculating a 14-period Simple Moving Average (SMA) based on the closing prices. The calculated values are stored in the MA_Buffer, and this data is then plotted as a line on the chart.

Step 6: Compile and Test

Once you’ve added the code, compile the indicator by pressing F7. If there are no errors, your indicator is ready! Now, go back to MetaTrader 4, and you’ll find your new “SimpleMA” indicator in the Navigator panel under Custom Indicators.

Drag it onto any chart, and you should see a line representing the 14-period moving average. Congratulations—you’ve just written your first MQL4 indicator!

Adding the Indicator to MetaTrader 4

After compiling your indicator, it will automatically appear in MT4’s Navigator window under Custom Indicators. Just drag and drop it onto any chart, and you’ll instantly see how it works. This is the exciting part—watching something you’ve coded come to life right in front of you.

If you want to customize the settings, like changing the moving average period, you can do so in the indicator’s properties window when you add it to the chart.

Testing and Optimizing Your Indicator

Now that you’ve got your first indicator working, the next step is testing it out in different market conditions. Does it give you the information you need? Is it clear and easy to understand?

If you feel it needs tweaking, don’t be afraid to go back into the code and make adjustments. One of the best things about MQL4 is the ability to optimize your indicators by trying different formulas or display methods until you find something that fits your trading style perfectly.

Understanding Key MQL4 Functions for Indicators

When you start writing custom indicators in MQL4, understanding the core functions is crucial. These functions help you access price data, draw visuals on the chart, and handle calculations. In this section, I’ll introduce some of the key MQL4 functions that are essential when creating indicators. Don’t worry—I’ll explain everything in a simple, easy-to-understand way!

Basic Functions for Indicators

Let’s start with a few fundamental functions that you’ll use frequently when coding your indicators in MQL4.

1. OnInit() Function

The OnInit() function is called when your indicator is first loaded on the chart. It’s where you set up the initial properties, such as defining indicator buffers or setting styles.

Here’s a basic structure of what it might look like:

int OnInit()

{

// Initialize buffers and settings here

return(INIT_SUCCEEDED);

}You’ll use this function to define how your indicator will behave when it’s added to a chart, such as setting buffer properties, names, or drawing styles.

2. OnCalculate() Function

The OnCalculate() function is the heart of your indicator. This is where all the calculations happen. It’s called whenever there’s a price update (a tick) or when the chart is refreshed.

Inside this function, you’ll loop through market data (like price, time, volume) and calculate values that your indicator will display. For example, if you’re building a moving average, the calculation will happen here.

int OnCalculate(const int rates_total,

const int prev_calculated,

const datetime &time[],

const double &open[],

const double &high[],

const double &low[],

const double &close[],

const long &tick_volume[],

const long &volume[],

const int &spread[])

{

// Your indicator's calculations go here

return(rates_total);

}This function is one you’ll use often, as it handles most of the core logic of your indicator.

3. SetIndexBuffer()

This function is used to assign buffers for your indicator. Buffers are arrays that store the values calculated by your indicator. Every custom indicator has at least one buffer.

SetIndexBuffer(0, MA_Buffer);This line connects the MA_Buffer (or whatever buffer you’re using) to the chart. Without it, your indicator wouldn’t be able to display any data visually.

4. SetIndexStyle()

The SetIndexStyle() function allows you to control how your indicator is drawn on the chart. For example, whether it’s a line, histogram, or arrow.

SetIndexStyle(0, DRAW_LINE);Here, we’re telling MQL4 that the first buffer (index 0) should be drawn as a line. You can experiment with different styles based on your indicator’s purpose.

Functions for Accessing Market Data

To create an effective indicator, you need to pull data from the market. MQL4 makes this easy with several built-in functions to get price data.

1. iClose()

The iClose() function retrieves the closing price of a specific candle (or bar) on a chart. You’ll use this function when you need closing prices for your indicator’s calculations.

double closePrice = iClose(NULL, 0, 0); // Gets the close price of the current barThe first argument (NULL) refers to the current symbol (like EUR/USD), and the second argument (0) refers to the current timeframe.

2. iHigh(), iLow(), and iOpen()

Similarly, you can use the iHigh(), iLow(), and iOpen() functions to get the highest price, lowest price, and opening price of a bar, respectively.

double highPrice = iHigh(NULL, 0, 1); // Gets the high price of the previous barThese functions are key when you’re building indicators that need to work with high, low, or open prices.

3. iMA()

If you’re building an indicator based on Moving Averages, the iMA() function is a lifesaver. This function calculates the moving average directly, so you don’t have to write the formula from scratch.

double maValue = iMA(NULL, 0, 14, 0, MODE_SMA, PRICE_CLOSE, 0);Here, we’re calculating a 14-period Simple Moving Average (SMA) based on the closing prices of the current symbol and timeframe.

Functions for Drawing Objects on the Chart

Besides just calculating values, MQL4 allows you to draw objects like lines or shapes directly on the chart. These are useful when you want to highlight certain areas or make your indicator more interactive.

1. ObjectCreate()

The ObjectCreate() function lets you create graphical objects on the chart. For instance, you might want to draw a horizontal line to mark a specific price level.

ObjectCreate(0, "MyLine", OBJ_HLINE, 0, 0, 1.1500);In this example, we’re creating a horizontal line at price level 1.1500 on the current chart.

2. ObjectSet()

Once an object is created, you can modify its properties using ObjectSet(). For example, you might want to change the color or thickness of a line.

ObjectSet("MyLine", OBJPROP_COLOR, clrRed); // Change the line color to redCreating More Advanced Custom Indicators

Once you’ve mastered the basics of MQL4, it’s time to move onto more advanced custom indicators. These are the indicators that go beyond simple moving averages and basic signals. In this section, I’ll guide you through how to create more complex indicators that can give you deeper insights into market behavior.

Why Build Advanced Custom Indicators?

So, why bother creating advanced indicators? As you get more experienced with trading, you’ll want tools that offer more than what’s available by default. An advanced indicator can give you an edge by combining different strategies, providing new perspectives, or even automating certain aspects of your analysis.

Some benefits of advanced indicators include:

- Combining Multiple Data Sources: Advanced indicators often take into account several types of market data, such as price, volume, and volatility.

- Custom Visuals: You can create more detailed visual displays that help you spot trends, reversals, or other key signals more effectively.

- Unique Strategies: With advanced indicators, you can develop and implement strategies that aren’t available with default indicators.

Step-by-Step Guide to Building Advanced Indicators

Let’s break down the process of building a more complex indicator. We’ll use the example of a custom RSI-MA hybrid indicator—an indicator that combines both the Relative Strength Index (RSI) and a Moving Average (MA) to help spot trend changes.

Step 1: Setting Up Buffers for Multiple Indicators

When creating advanced indicators, you’ll often need multiple buffers to handle different parts of your calculations. In this case, we’ll need one buffer for the RSI values and another for the Moving Average.

double RSI_Buffer[];

double MA_Buffer[];We’ll use these buffers to store the values for our RSI and Moving Average calculations, respectively.

Step 2: Calculate RSI Values

First, we’ll calculate the RSI values using the iRSI() function. This function is built into MQL4 and makes it easy to calculate RSI without writing it from scratch.

int OnCalculate(const int rates_total,

const int prev_calculated,

const datetime &time[],

const double &open[],

const double &high[],

const double &low[],

const double &close[],

const long &tick_volume[],

const long &volume[],

const int &spread[])

{

for(int i=0; i<rates_total; i++)

{

RSI_Buffer[i] = iRSI(NULL, 0, 14, PRICE_CLOSE, i);

}

}This code loops through all the candles on the chart and calculates the 14-period RSI based on the closing prices.

Step 3: Calculate the Moving Average of RSI

Next, we’ll smooth the RSI values by applying a Moving Average to them. This can help filter out noise and give you a clearer view of the overall trend. We’ll use the iMAOnArray() function, which allows us to apply a moving average to the RSI buffer.

for(int i=0; i<rates_total; i++)

{

MA_Buffer[i] = iMAOnArray(RSI_Buffer, rates_total, 10, 0, MODE_SMA, i);

}Here, we’re calculating a 10-period Simple Moving Average (SMA) of the RSI values. This creates a smooth line that helps indicate when the market might be overbought or oversold.

Step 4: Add Visual Elements

To make your advanced indicator more useful, you’ll want to add visual elements, such as colored lines or histograms. In this case, we’ll display both the RSI and the smoothed Moving Average as lines on the chart.

SetIndexBuffer(0, RSI_Buffer);

SetIndexStyle(0, DRAW_LINE, STYLE_SOLID, 2, clrBlue);

SetIndexBuffer(1, MA_Buffer);

SetIndexStyle(1, DRAW_LINE, STYLE_SOLID, 2, clrRed);This code sets up two lines: one for the RSI (blue) and one for the Moving Average (red). Both lines will be drawn on the same chart, giving you a visual comparison of the RSI and its smoothed version.

Step 5: Optimize and Test

Once you’ve got your code set up, compile the indicator and test it in MetaTrader 4. You can experiment with different settings, like adjusting the period of the Moving Average or RSI, to see how the indicator behaves in different market conditions.

Remember, advanced indicators are meant to be customized to your trading strategy. So don’t be afraid to tweak parameters or even add additional features as you go.

Examples of Advanced Custom Indicators

Let’s take a look at a few examples of advanced custom indicators that many traders use to get more detailed insights into the market.

1. MACD with Custom Signal Line

The MACD (Moving Average Convergence Divergence) indicator is already a powerful tool, but by adding a custom signal line or tweaking its settings, you can create a version that suits your specific needs. For instance, you could apply different moving averages or add a volatility filter.

2. Custom Bollinger Bands

Bollinger Bands are popular for identifying overbought and oversold conditions, but you can create a custom version that uses different standard deviations or timeframes. You might also add alerts when the price crosses certain levels.

3. Multi-Timeframe Indicators

One of the most useful advanced indicators is a multi-timeframe indicator. This type of indicator pulls data from different timeframes (like M1, M5, H1) and combines them into one display. For instance, you can create a multi-timeframe RSI that shows overbought/oversold conditions on multiple charts at once.

Tips for Building Advanced Indicators

Creating advanced custom indicators can seem overwhelming, but with the right approach, you’ll find it’s just a matter of combining basic building blocks. Here are a few tips to help:

- Start Simple: Build your indicator in stages. Start with basic calculations, then layer on more complex logic and visuals as you go.

- Test Often: Make sure to test your indicator in different market conditions to see how it performs. Markets can be unpredictable, so it’s important to know how your tool behaves in volatile times.

- Experiment with Different Functions: Don’t be afraid to try out new MQL4 functions or methods. Many of the advanced indicators out there were created by experimenting and testing new ideas.

Debugging and Troubleshooting in MQL4

As you dive deeper into MQL4 programming, you’ll soon realize that debugging and troubleshooting are essential skills. No matter how experienced you are, bugs can creep into your code, and indicators can misbehave. In this section, I’ll share some of my best tips and strategies for debugging and troubleshooting MQL4 code so you can keep your indicators running smoothly.

Why Debugging is Important

Debugging isn’t just about fixing errors; it’s about improving your coding skills and creating reliable indicators. A well-debugged indicator can save you from making costly mistakes in live trading. Here are a few reasons why debugging is crucial:

- Identify Issues Early: Finding and fixing bugs early in your development process saves you time and frustration later.

- Improve Indicator Performance: Debugging helps you refine your indicators, making them more efficient and responsive to market conditions.

- Boost Your Confidence: Knowing how to troubleshoot effectively boosts your confidence as a programmer, allowing you to take on more complex projects.

Common Bugs in MQL4

Before we dive into troubleshooting strategies, let’s look at some of the most common bugs you might encounter when working with MQL4.

1. Syntax Errors

These are the simplest errors to spot but can be incredibly frustrating. Syntax errors occur when the code doesn’t follow the rules of the programming language, like forgetting a semicolon or mismatching parentheses.

2. Runtime Errors

Runtime errors happen when your code is syntactically correct but encounters a problem during execution, such as trying to divide by zero or accessing an array out of bounds.

3. Logic Errors

These can be the trickiest to find because the code runs without crashing, but the output isn’t what you expect. For example, your calculations may be correct, but the logic used to interpret the data may be flawed.

4. Buffer Issues

When working with indicators, buffer-related issues are common. This might include not properly initializing buffers, misusing the buffer size, or not linking the buffer correctly to the indicator display.

Debugging Strategies

Now that we know what to look out for, let’s discuss some practical debugging strategies you can use to identify and fix bugs in your MQL4 code.

1. Use the MetaEditor Debugger

MetaTrader 4 comes with a built-in debugger in the MetaEditor. This tool allows you to step through your code line by line, helping you identify where things go wrong. Here’s how to use it:

- Set Breakpoints: Place breakpoints in your code by clicking on the left margin next to the line number. This will pause execution when it hits that line.

- Step Through Code: Use the “Step Into” feature to execute your code line by line. This helps you see how data changes as your program runs.

- Watch Variables: Keep an eye on variable values in real-time. You can add variables to the Watch window to monitor their changes as you step through the code.

2. Use Print Statements

Sometimes, the simplest method to find bugs is to use print statements. You can insert Print() commands in your code to output variable values and messages to the Experts log. This can help you track the flow of your code and see where things might be going wrong.

For example:

Print("Current RSI value: ", RSI_Buffer[i]);This line will print the current RSI value to the log, allowing you to check if it’s being calculated as expected.

3. Check the Log Files

After running your indicator, always check the log files in the Terminal under the “Experts” tab. Any runtime errors or unexpected behaviors will often generate warnings or error messages here, giving you clues about what went wrong.

Testing in Different Environments

It’s also a good idea to test your indicators in different environments, such as:

- Different Timeframes: Sometimes, bugs may only appear on specific timeframes. Testing across multiple timeframes can help catch these issues.

- Demo vs. Live Accounts: Always test in a demo environment before deploying to a live account. This allows you to catch any unforeseen errors without risking real money.

Common Troubleshooting Tips

Here are some additional troubleshooting tips that can help you resolve issues more efficiently:

1. Break Down the Problem

If your indicator isn’t working as expected, break the problem down into smaller parts. Test individual components to see which part of your code is causing the issue.

2. Consult the Documentation

MQL4 has extensive documentation available online. If you’re stuck, check the MQL4 Reference or forums for insights and solutions to similar problems faced by other developers.

3. Seek Help from the Community

Don’t hesitate to ask for help in forums like MQL5 Community or Stack Overflow. The programming community is often more than willing to assist with troubleshooting and debugging.

Debugging and troubleshooting in MQL4 is a skill that you’ll develop over time. It’s all about practice and learning from your mistakes. By understanding common bugs, using the right tools, and following best practices, you’ll become more proficient in diagnosing and fixing issues in your code.

Optimizing Indicator Performance

Once you’ve developed your MQL4 indicators, the next step is to ensure they perform at their best. Optimizing indicator performance is crucial for getting accurate signals and ensuring they respond effectively to changing market conditions. In this section, I’ll share some of my favorite tips and techniques to help you optimize your indicators for maximum efficiency.

Why Optimization Matters

Before diving into the specifics, let’s talk about why optimization is so important:

- Faster Execution: Well-optimized code runs more quickly, which can be especially important when trading in fast-moving markets.

- Accurate Signals: Optimization helps ensure your indicators provide reliable signals, reducing false positives and improving decision-making.

- Resource Management: Efficient indicators use fewer system resources, allowing your trading platform to run smoothly without lag.

Key Areas for Optimization

Here are some key areas where you can focus on optimizing your MQL4 indicators:

1. Code Efficiency

First and foremost, review your code for efficiency. This means looking for ways to make your code run faster without sacrificing functionality. Here are a few tips:

- Minimize Loops: Use loops wisely. Instead of looping through all the data points every tick, consider calculating values only when necessary.For example, if your indicator doesn’t need to update on every tick, set it to update only once every few ticks.

- Avoid Unnecessary Calculations: If you’re performing calculations that don’t change frequently, save the result instead of recalculating it every time.

- Use Built-in Functions: MQL4 has many built-in functions optimized for performance. Whenever possible, use these instead of writing your own custom calculations. For instance, instead of manually calculating the average, use the built-in

iMA()function for moving averages.

2. Limit Buffer Usage

Every indicator uses buffers to store data, but excessive buffer usage can slow down performance. Here are a few ways to manage buffers effectively:

- Minimize Buffer Size: Only allocate as many buffers as you need. For example, if your indicator only needs to track a few values, don’t create unnecessary additional buffers.

- Use the Correct Buffer Type: Depending on what you’re measuring, make sure you’re using the right type of buffer. For instance, if you need to store values as integers, don’t use double buffers unnecessarily.

3. Reduce Chart Load

The more complex your indicator is, the more it can slow down your chart. Here are a few strategies to reduce chart load:

- Simplify Visuals: Complex visuals can take a toll on performance. If your indicator has intricate graphics, consider simplifying them or providing an option to toggle advanced graphics off.

- Limit Number of Calculations: Only perform calculations that are essential for your trading strategy. If some features are rarely used, consider making them optional.

4. Use OnTimer Function

Instead of executing your calculations on every tick, consider using the OnTimer function to schedule updates. This allows you to control how often your indicator performs calculations, which can greatly enhance performance.

Here’s a simple example:

void OnTimer()

{

// Perform calculations here

}You can set a timer using EventSetTimer(seconds) to control how often the OnTimer function runs. This helps in managing CPU load, especially for indicators that require heavy computations.

Testing and Iterating

Once you’ve implemented optimizations, it’s crucial to test your indicators to see how well they perform. Here’s how you can approach this:

1. Backtesting

Backtesting allows you to simulate how your indicator would have performed in the past using historical data. This helps you see how well your optimizations are working and if your indicator still provides reliable signals.

- Use the Strategy Tester: In MetaTrader 4, use the built-in Strategy Tester to run your indicator against historical data. This will give you valuable insights into its performance.

2. Forward Testing

After backtesting, it’s essential to forward test your indicator in a demo environment. This helps you see how it performs in real-time without risking actual funds. Monitor the indicator closely and note any discrepancies between backtesting results and live performance.

3. Gather Feedback

If you share your indicators with others or have a trading community, consider gathering feedback. Other traders can provide valuable insights on how your indicators perform in different market conditions, helping you identify areas for further optimization.

Optimizing your MQL4 indicators is an ongoing process that requires regular review and adjustments. By focusing on code efficiency, managing buffers, and limiting chart load, you can significantly improve your indicators’ performance.

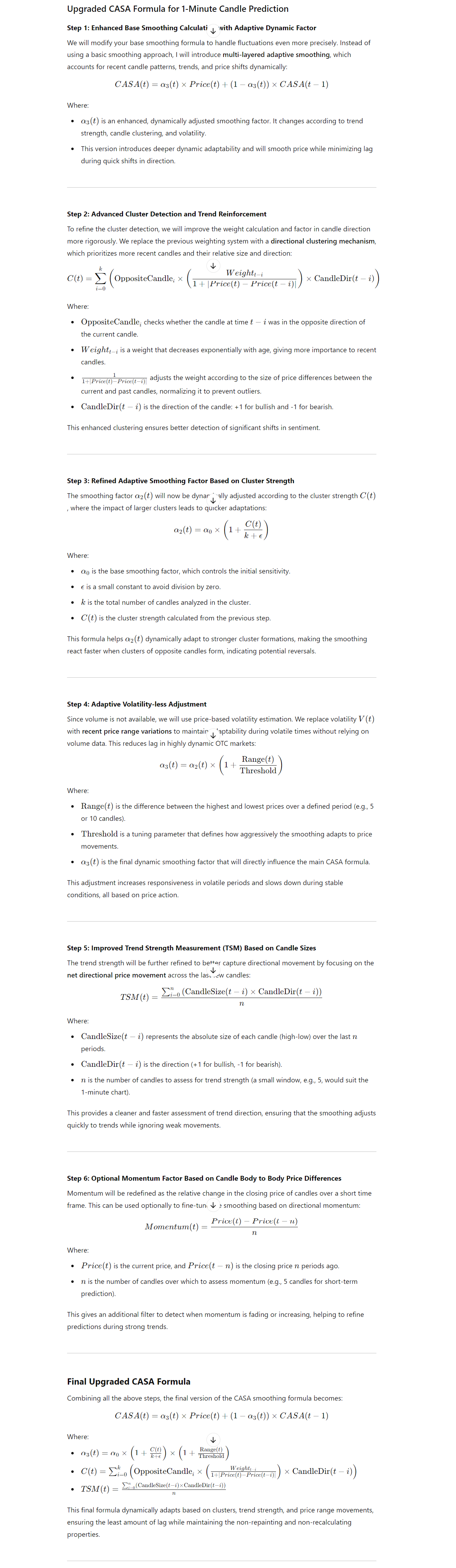

Exploring My Custom Indicator: Cluster Adaptive Smoothing Average (CASA)

I’ve developed a custom indicator called Cluster Adaptive Smoothing Average (CASA) that brings a more dynamic and responsive approach to calculating moving averages. This isn’t your typical moving average—it adapts based on cluster patterns, trend strength, and recent price movements. Let’s dive into what makes CASA unique and how it works mathematically.

How CASA Works: A Breakdown of the Formula

At its core, CASA combines multiple factors to provide a smoothed average that reacts to market conditions in a more refined way. It focuses on clusters, trend strength, and adaptive smoothing, making it particularly effective for short-term price prediction.

Here’s the step-by-step breakdown of how CASA is calculated:

1. Enhanced Smoothing with Adaptive Dynamic Factor

In traditional smoothing, a constant smoothing factor is used. However, CASA uses a more adaptive dynamic smoothing factor to adjust depending on recent price patterns. Here’s the core part of the formula:CAS(t)=α3(t)×Price(t)+(1−α3(t))×CAS(t−1)CAS(t) = \alpha_3(t) \times Price(t) + (1 – \alpha_3(t)) \times CAS(t – 1)CAS(t)=α3(t)×Price(t)+(1−α3(t))×CAS(t−1)

Where:

- α3(t)\alpha_3(t)α3(t) is the adaptive smoothing factor that adjusts dynamically based on trend strength and recent price action.

- Price(t) is the current price at time ttt.

- CAS(t – 1) is the previous smoothed value.

The smoothing factor α3(t)\alpha_3(t)α3(t) is dynamic and ensures responsiveness to changing market conditions. This part of the formula helps minimize lag while keeping the average in line with market movements.

2. Cluster Detection and Trend Reinforcement

The next part of CASA refines the cluster detection to improve how it weights candles and reinforces trends. We use a cluster detection formula that gives priority to recent candles and identifies whether they are reinforcing the current trend or moving against it.C(t)=∑i=0k(OppositeCandlet−i×(Weighti1+∣Price(t)−Price(t−i)∣)×CandleDir(t−i))C(t) = \sum_{i=0}^{k} \left(OppositeCandle_{t – i} \times \left( \frac{Weight_{i}}{1 + |Price(t) – Price(t – i)|} \right) \times CandleDir(t – i)\right)C(t)=i=0∑k(OppositeCandlet−i×(1+∣Price(t)−Price(t−i)∣Weighti)×CandleDir(t−i))

Where:

- OppositeCandle checks whether the current candle is in the opposite direction of the recent trend.

- Weight adjusts based on the recent price movements, giving more importance to candles closer to the current one.

- CandleDir(t – i) is the direction of the candle, where +1 represents bullish and -1 represents bearish candles.

This clustering mechanism helps detect shifts in market sentiment early, allowing CASA to react more quickly to trend reversals.

3. Adaptive Smoothing Factor Based on Cluster Strength

CASA further refines the smoothing factor by making it cluster-aware. The smoothing factor is adjusted based on the strength of the cluster, which is calculated from the previous step.α2(t)=α0×(1+C(t)k+ϵ)\alpha_2(t) = \alpha_0 \times \left( 1 + \frac{C(t)}{k + \epsilon} \right)α2(t)=α0×(1+k+ϵC(t))

Where:

- α0\alpha_0α0 is the base smoothing factor.

- C(t) is the cluster strength calculated from the previous formula.

- k is the total number of candles analyzed in the cluster.

- ϵ\epsilonϵ is a small constant to avoid division by zero.

This adaptive factor makes CASA more responsive when clusters of opposing candles form, leading to quicker adjustments during potential reversals.

4. Adaptive Volatility Adjustment

To further refine the smoothing, CASA adjusts based on price range variations instead of relying on traditional volatility measures.α3(t)=α2(t)×(1+Range(t)Threshold)\alpha_3(t) = \alpha_2(t) \times \left( 1 + \frac{Range(t)}{Threshold} \right)α3(t)=α2(t)×(1+ThresholdRange(t))

Where:

- Range(t) is the difference between the highest and lowest prices over a defined period (e.g., 5 or 10 candles).

- Threshold is a tuning parameter that defines how aggressively the smoothing adjusts to price movements.

This factor ensures that CASA adapts based on recent volatility, making it effective even during quiet or extremely volatile markets.

The Final CASA Formula

After combining the dynamic smoothing, cluster strength, and volatility adjustments, the final CASA formula is:CAS(t)=α3(t)×Price(t)+(1−α3(t))×CAS(t−1)CAS(t) = \alpha_3(t) \times Price(t) + (1 – \alpha_3(t)) \times CAS(t – 1)CAS(t)=α3(t)×Price(t)+(1−α3(t))×CAS(t−1)

Where:

- α3(t)\alpha_3(t)α3(t) is dynamically calculated based on the cluster strength and recent price range.

- Price(t) is the current price.

- CAS(t – 1) is the previous smoothed value.

Here’s a basic code snippet that outlines how the mathematical calculations for CASA would look in MQL4:

double CAS(double price, int shift) {

// Step 1: Calculate cluster strength

double clusterStrength = 0;

for(int i = 0; i < k; i++) {

double weight = Weight(i) / (1 + MathAbs(price - Price(i)));

double candleDir = CandleDir(i);

clusterStrength += OppositeCandle(i) * weight * candleDir;

}

// Step 2: Calculate adaptive smoothing factors

double alpha_0 = 0.1; // Base smoothing factor

double alpha_2 = alpha_0 * (1 + clusterStrength / (k + epsilon));

double range = High[shift] - Low[shift]; // Price range

double alpha_3 = alpha_2 * (1 + range / Threshold);

// Step 3: Calculate final CASA value

double cas_prev = iCustom(NULL, 0, "CASA", shift + 1); // Previous CASA value

double cas = alpha_3 * price + (1 - alpha_3) * cas_prev;

return cas;

}In this code:

- Cluster strength is calculated by looping through recent candles, adjusting for their direction and weight.

- Adaptive smoothing factors are dynamically adjusted based on the cluster strength and price range.

- The final CASA value is calculated based on the current price and the previous smoothed value.

Why CASA is Different

The reason why CASA stands out is because it dynamically adapts based on real-time price action and trend reversals. Traditional moving averages often suffer from lag, but CASA’s ability to adjust for clusters and volatility helps it stay responsive without lagging behind significant market shifts.

This makes CASA especially useful for scalpers and short-term traders who need more accurate and real-time smoothed averages to inform their trading decisions.

Tips for Learning MQL4 Faster

Learning MQL4 can be an exciting journey, but it can also feel overwhelming at times. Trust me; I’ve been there! With so much to grasp, finding effective ways to speed up the learning process is key. In this section, I’ll share some practical tips that have helped me and many others learn MQL4 faster and more efficiently.

Set Clear Goals

Before diving into MQL4, it’s essential to set clear goals. What do you want to achieve? Whether it’s creating your own indicators, developing expert advisors, or simply understanding how to automate your trading strategies, having a goal helps you stay focused.

- Short-term Goals: Start with small, achievable goals. For instance, aim to create a simple moving average indicator in your first week.

- Long-term Goals: Think about where you want to be in a few months. Maybe you want to develop a full trading system or create custom scripts. Having a long-term vision keeps you motivated.

Start with the Basics

It might be tempting to jump into advanced topics right away, but I recommend starting with the basics. Familiarize yourself with the fundamental concepts of programming and MQL4 syntax. Here’s how to approach it:

- Learn Basic Syntax: Understand data types, variables, and control structures (like loops and conditionals). This foundation will make learning more complex topics easier.

- Understand the MetaTrader Environment: Spend some time navigating the MetaTrader platform. Learn where everything is located, including the MetaEditor, strategy tester, and charting tools.

Practice Regularly

Practice makes perfect! The more you code in MQL4, the more comfortable you’ll become. Set aside dedicated time each day or week to practice coding. Here are some ideas:

- Coding Exercises: Try small coding challenges or exercises. For instance, write a function that calculates the average of a given array.

- Build Mini-Projects: Start small projects, like creating a simple indicator or a basic expert advisor. These projects will help reinforce what you’ve learned and give you practical experience.

Use Online Resources

There’s a wealth of online resources available to help you learn MQL4. Don’t hesitate to utilize them! Here are some of my favorite go-to resources:

- MQL4 Documentation: The official documentation is an excellent starting point. It covers everything from basic syntax to advanced functions.

- Online Forums: Join communities like the MQL5 community or trading forums. These places are gold mines for information, tips, and advice from experienced developers.

Learn from Examples

One of the best ways to learn is by studying real-life examples. Look at existing indicators and expert advisors to see how they’re structured. Here’s how to approach this:

- Download Free Indicators: There are plenty of free indicators available online. Download them, study the code, and see how they implement various functions.

- Analyze Code Snippets: When you find code snippets in forums or articles, try to understand how they work. Experiment by modifying them to see what changes.

Don’t Be Afraid to Experiment

Sometimes, the best way to learn is by experimenting. Don’t be afraid to break things! Here’s how to approach experimentation:

- Modify Existing Code: Take existing indicators or scripts and modify them. Change parameters, add new features, or combine different functionalities. This hands-on experience is invaluable.

- Create Your Own Functions: Try writing your own functions for common tasks. This practice not only reinforces your learning but also helps you become more comfortable with coding.

Seek Feedback

Getting feedback on your code can accelerate your learning process. Here’s how to seek constructive feedback:

- Join Coding Communities: Share your code in forums and ask for feedback. Other developers can provide insights and suggestions for improvement.

- Pair Programming: If you know someone else learning MQL4, consider working together. Pair programming allows you to discuss your thought process and learn from each other.

Stay Updated

The world of trading and programming is always evolving. To keep your skills sharp, make it a habit to stay updated on MQL4 developments:

- Follow Blogs and Tutorials: Subscribe to blogs, YouTube channels, or newsletters focused on MQL4. This keeps you informed about new techniques and best practices.

- Attend Webinars or Workshops: Look for online webinars or workshops. These sessions often cover valuable topics and provide the opportunity to ask questions.

Be Patient and Persistent

Learning a new programming language takes time, and it’s natural to feel stuck sometimes. Remember to be patient with yourself. Progress might feel slow, but persistence is key. Here’s how to stay motivated:

- Celebrate Small Wins: Acknowledge and celebrate your achievements, no matter how small. Each step forward is progress.

- Keep a Journal: Document your learning journey. Write down what you’ve learned, challenges you’ve faced, and how you overcame them. This can be a great motivation boost!

Learning MQL4 can be a rewarding experience, especially when you see your indicators and strategies come to life. By setting clear goals, practicing regularly, and utilizing available resources, you can accelerate your learning process and become proficient in MQL4.

Conclusion

As we wrap up this journey into the world of MQL4, I want to take a moment to reflect on what we’ve covered and the exciting path ahead. Learning MQL4 and mastering the art of creating custom indicators can be a game-changer for your trading experience. It opens up a world of possibilities, allowing you to tailor your trading strategies to your specific needs.

A Quick Recap

Throughout this guide, we’ve explored the fundamentals of MQL4, starting from the basics and progressing to more complex topics like debugging, optimization, and custom indicator development. Here are some key takeaways:

- Understanding MQL4: We discussed what MQL4 is and its importance in algorithmic trading. This foundation is essential for anyone looking to enhance their trading through automation.

- Getting Started: I shared how to set up your environment and write your first indicator. These initial steps are crucial for building your confidence as a programmer.

- Indicators and Customization: We covered various types of indicators and how to create custom ones. Knowing how to manipulate indicators to suit your trading style is a valuable skill.

- Debugging and Optimization: I highlighted the importance of debugging and optimizing your code for better performance. These skills will help you troubleshoot issues and enhance the efficiency of your indicators.

- Learning Strategies: Lastly, I provided tips for learning MQL4 faster. Remember, learning is a journey, and finding the right strategies will help you stay motivated.

In conclusion, learning MQL4 is a rewarding endeavor that can significantly enhance your trading skills. Remember that every expert was once a beginner, so be patient with yourself and enjoy the process. With practice, persistence, and a passion for learning, you’ll be well on your way to mastering MQL4 and creating powerful indicators tailored to your trading strategy.